For those who were unable to attend, we compiled the key takeaways of the webinar featuring professor Ralph Koijen, AQR Capital Management Distinguished Service Professor of Finance and Fama Faculty Fellow at the University of Chicago’s Booth School of Business.

Koijen’s research, in collaboration with Xavier Gabaix from Harvard University, focuses on finding the drivers of market volatility, a relevant topic for practitioners, especially in light of the recent price shifts in the market. “If you look at what happened just over the last few weeks, there are days when the market is up 2 or 3 percent and there are days, like last week Monday (13 June), where the US market falls by almost 4%. We are trying to understand what could be driving this,” the professor explained.

Gabaix and Koijen first develop a framework to connect prices, fundamentals, but also portfolio holdings and flows. Using this framework they analyze the elasticity of the aggregate stock market, and ask how much prices move in response to flows and demand shocks of investors. As a point of reference, standard asset pricing models – both rational and behavioral models – imply that markets are highly macro elastic. “These models imply that prices would move by less than 1% if a sovereign wealth fund were to buy 10% of the US stock market, for example. That has broad practical implications, as it implies that flows in financial markets quantitatively matter little for prices and expected returns.”

Koijen’s research offers a different view. It suggests that flows and demand shocks have a more significant impact on prices and expected returns, which is referred to as the ‘inelastic markets hypothesis’. Koijen: “One view is that the price impact of those flows is very small. If you were to buy about 1 billion dollars in US equities, you would move prices by just a bit, maybe 10 million? However, there is growing evidence that shows that prices might move a lot more when you would do that – more in the direction of 1 billion, maybe even 5 billion.”

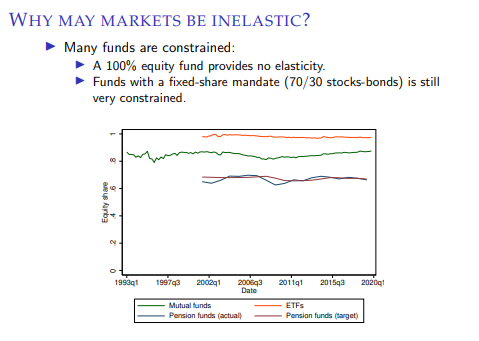

To provide further strength to this hypothesis, Koijen observed that a significant portion of market funds are constrained when it comes to their allocation towards stocks or bonds. “If you have a fund that is 100% invested in equities, such as an S&P500 index fund, you cannot provide elasticity to the market if the market goes up or down – you just have to hold the market. The way you can think about the market is that there are a lot of institutions – pension funds, insurance companies, sovereign wealth funds, mutual funds, ETF’s – with a fixed share mandate, with many of them being quite constrained and not deviating much from their mandates.”

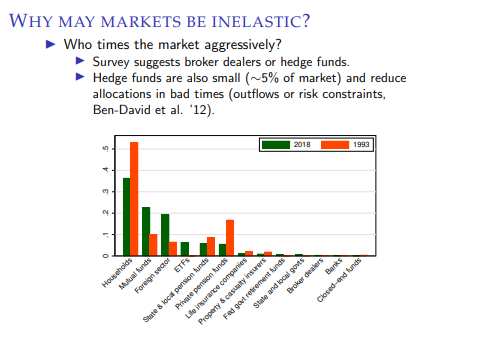

In addition, Koijen explained that, even though there are players that can time the market to potentially provide elasticity in the market, their contributions are often not significant enough for the aggregate market. “According to a survey amongst industry practitioners and academics, the groups that people point to in terms of providing elasticity and stepping in when markets fall, are either broker dealers or hedge funds. If you look at who owns equities, you can see that the third smallest group are broker dealers. If broker dealers have to step in to absorb large flows, they can maybe do this over very short periods of time, but if you think of a large flow coming in from larger players, broker dealers are simply too small to provide much elasticity.”

“Hedge funds are larger, they own about 5% of the market. But if you look at their behavior, they may actually amplify shocks during times of stress”, Koijen explained. “During bad times, hedge funds may experience outflows themselves, because of redemptions, and risk constraints bind. Hedge funds therefore actually sell in times of stress instead of providing elasticity. This suggests that there are very few players in the market that can provide elasticity during large outflows.”

After discussing the economics of flows and prices in macro-inelastic markets and providing multiple examples, Koijen concluded his presentation by offering a couple of key takeaways and implications for further research. “The main message that we want to convey is that we think that markets are more inelastic than what is implied by standard asset pricing models. The advantage of that is that it may make financial markets more interpretable. Using the framework, it is possible to trace back asset price movements at any given point to individual investors or groups of investors. This offers a potential way to answer difficult questions, such as which investors moved the market during certain episodes. With this framework such questions hopefully become a lot more concrete and tangible.”

Interested in learning more about the research? Read the paper or watch a replay of the webinar