Sovereign credit risk evolution is considered a major driver of economic cycles and an indicator of financial stress. Such crises have arisen more frequently in emerging markets in recent years. For this reason, Chukwuma Dim (George Washington University) and his peers Kevin Koerner, Marcin Wolski, and Sanne Zwart (European Investment Bank) have worked develop a new way to track the risks associated with sovereign debt default as discussed in their research ‘Hot Off the Press: News-Implied Sovereign Default Risk’.

Mr. Dim presented the research during the Inquire Europe Spring Seminar in March. For those of you who missed it, we’ve created a synopsis.

“We have seen a huge increase in sovereign debt, and this is troublesome because debt crises and elevated sovereign risk have far-reaching adverse implications for local as well as global economic and financial stability.

Rising interest rates and a surge in sovereign debt from upwards of 60% of global GDP in 2009 to 110% in 2021 have sparked a lot of concerns about the risks associated with excessive debt. The ongoing debate about how much government debt is sustainable misses the crucial issue of adapting sovereign risk measurement to today’s fast-paced and highly interconnected financial system.

Those attempting to track sovereign default risk currently rely on two standard approaches: one is analyzing macroeconomic fundamentals, which is backward-looking and relies on low-frequency information; the other is to look at market-based measures, most commonly Credit Default Swaps (CDS) spreads. While these measures are highly informative and useful in different contexts, we think that there are important shortcomings in relying solely on them.

For instance, when relying on low-frequency macroeconomic indicators, one is not gathering information consistently, and this can lead to reactive policy decisions. On the other hand, market-based measurements simply aren’t available for the vast majority of countries. Therefore, there is huge potential to apply unstructured and high-frequency data in the form of news text, as this will overcome these previously mentioned limitations.

It is shown that news media text condenses information that is highly useful, reflecting concerns and perceptions of future risks. Furthermore, it is observable in real-time and is obtainable for most countries. We have developed a high-frequency text-based measure of sovereign default risk called the News-implied Sovereign Risk Index (NSRI); it can be computed for any country in real-time by applying natural language processing techniques to news text. This technique is not impeded by liquidity problems in the same way that CDS spreads are.

Our risk index, NSRI, tracks sovereign default risk by doing multiple things: it correlates with and predicts monthly CDS spreads’ dynamics; predicts future sovereign rating downgrades up to six months in advance; predicts sovereign default that could happen in the coming two years; and importantly, it provides incremental information in addition to other variables – such as CDS spreads and macroeconomic fundamentals.

We also apply the NSRI to revisit theoretical predictions on how sovereign default risk spills over to different segments of the economy even when unaccompanied by a realized default. We show that our NSRI predicts an increase in firm-level default probability and default protection cost as well as a decrease equity valuation.

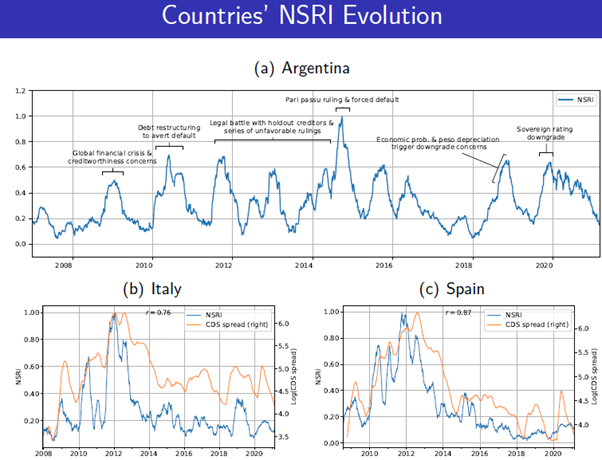

The following charts provide a good visualization of how the NSRI tracks the sovereign default risk evolution for Argentina, Italy and Spain:

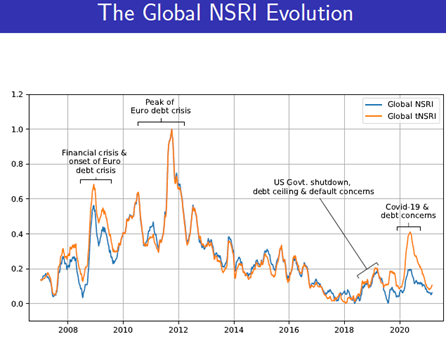

As well as global debt crises:

To conclude, we are able to establish that the NSRI is informative about future sovereign risk evolution – not only by supplementing existing measures– but can also be used as a standalone high-frequency sovereign default risk indicator. This makes our index particularly valuable for emerging markets that lack market-based measures. The NSRI does support theoretical predictions on the micro-economic and equity market spillover effects of sovereign default risk. And finally, we confirm that news media narratives do contain valuable information about specific countries which can be useful for tracking default concerns in real-time.”

Inquire Europe members can access the research and the presentation slides via: https://www.inquire-europe.org/event/joint-spring-seminar-2023/