Environmental concerns play and increasing role in financial markets, which has led to a surge in sustainable investing. What is the impact of this growing appetite for sustainable investing on stock returns and firms’ behavior?

Marie Brière (Amundi and Université Libre de Bruxelles and newly appointed Chair of the Institute) presented on the results of her recent research during the joint Inquire Europe and Inquire UK autumn seminar in October 2022. The research, which is joint work with Stefano Ramelli (Assistant Professor at University of St Gallen), has also been awarded with the Inquire 2022 prize for the best paper presented at the seminar. For those who were unable to attend the seminar, we have created a summary of Ms. Brière’s presentation:

“In theory green assets are less risky and should thus have lower return in equilibrium, but they can also outperform in upward shifts towards green preferences. The past decade was a period of outperformance of green stocks; and this led for example the BIS to warn of the possibility of a ‘green bubble’. However, with the war in Ukraine, appetite for ESG investing has declined. We see that these preferences can fluctuate and they can have a large impact on stock returns.

Identifying the impact of green preferences is tricky because changes in investors’ preferences are not easily observable, and it is difficult to disentangle changes in preferences (driven by non-fundamental demand shocks), from changes in expectations about firms’ risk exposure and cash flows (fundamental demand). In our paper, we propose a novel way to estimate changes in investors’ non-fundamental preferences for green assets, and to quantify their impact on stock returns.

We analyze the arbitrage activity — the creation and redemption of shares in the ETF primary markets — of Exchange traded funds (ETF) with explicit climate-conscious features. We argue that observable flows in or out ETFs reflect the presence of non-fundamental demand. The intuition is simple. ETFs and their underlying assets (individual stocks) have the same fundamental value, but ETFs are more prone to sentiment than underlying assets, due to their different ownership, more tilted towards retail investors. Given these differences, non-fundamental demand shocks impact an ETF’s price differently from its underlying securities. Violations of the law of one price reveal non-fundamental demand. These mispricings incentivize arbitrageurs to create or redeem ETF shares to correct the mispricing, creating observable ETF flows.

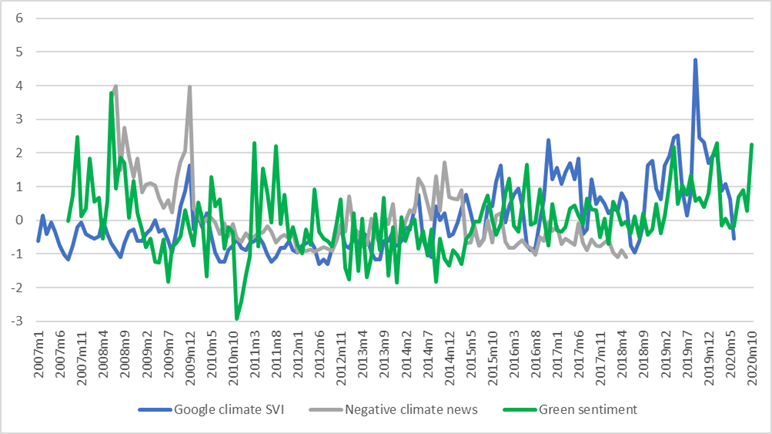

We use the estimated abnormal flows into green ETFs to build a Green Sentiment Index, measuring the changes in investor non-fundamental appetite for climate responsibility.

Fig1: Evolution of the Green Sentiment index

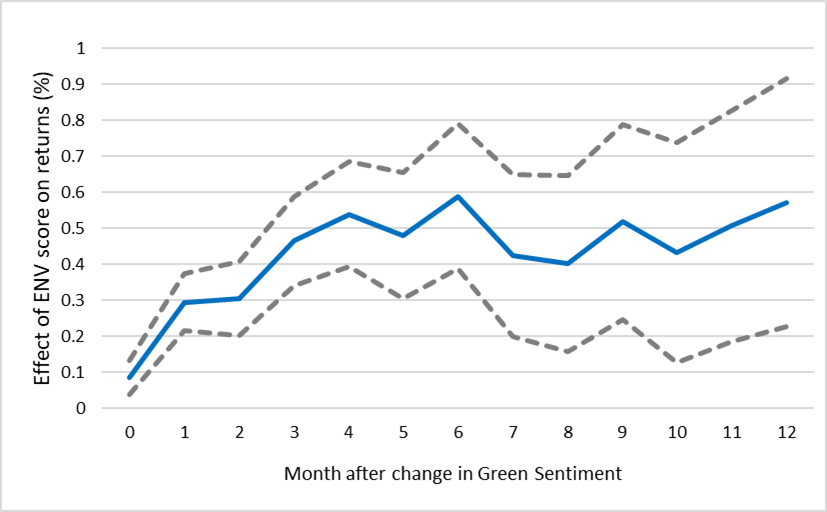

We show that over the last 10 years, a one-standard-deviation higher green sentiment was associated with an out-performance of green firms of approximately 60 basis points over a six-month horizon.

Fig2: Effect of a one-standard-deviation higher Green Sentiment in t=0

Importantly, the effect of green sentiment is independent from, and additional to the effect of climate fundamental information, as proxied by negative news related to climate change. Both factors, fundamental and non-fundamental demand for green assets, impact stock prices, although through different channels.

A key result of our study and a fundamental difference between “green” and “traditional” sentiment in financial markets is that green sentiment has – at least over the sample period covered — a long-lasting impact on returns and a real impact on firms’ decisions. A one-standard-deviation higher green sentiment is associated with a 5% relative increase in capex investment for green firms.

We also looked at the heterogeneity across ratings, or a firms’ access to capital and equity dependence proxied by their rating. We find that the green sentiment on capital investments is concentrated on firms with low or medium credit ratings. The impact of green sentiment on cash holdings is also larger for firms with low credit ratings. It looks like green sentiment has a greater impact on firms which are financially constrained.

Changes in investor sentiment for green assets have the power to shift investments from “brown” to “green” companies, which affects the cost of capital of green firms and, in turn, affects their capital investment decisions, in a potentially virtuous circle.

Reference:

Brière M. and S. Ramelli, “Green Sentiment, Stock Returns, and Corporate Behavior”, SSRN Working Paper N°3850923, 2021. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3850923